Bangladesh

Bangladesh is a founding member of the South Asia Subregional Economic Cooperation (SASEC) Program, joining with Bhutan, India, and Nepal in 2001 to form this project-based partnership. Maldives and Sri Lanka became full members of SASEC in May 2014, following several years as active observers.

The Twelfth Five Year Plan for 2018–2023 of the Government of Bangladesh focuses on the following core themes: i) rapid recovery from COVID-19; ii) GDP growth acceleration, employment generation, and rapid poverty reduction with a broad-based strategy of inclusiveness; iii) a sustainable development pathway resilient to disaster and climate change; iv) sustainable use of natural resources and successful management of the inevitable urbanization transition v) development and improvement of critical institutions; and vi) attaining targets of the Sustainable Development Goals and coping with the impact of graduation from least developed country status. In follow up to the the Seventh Five Year Plan FY2016-F2020, the transport sector strategy places emphasis in areas where performance gaps exist to develop an efficient, sustainable, safe, and regionally balanced transportation system. The plan highlights the introduction of modern technology for increasing capacity and improving quality and productivity of the system, development of the two seaports with smooth transport links to Dhaka, establishment of effective railway linkages between the east and west zones of the country, integration of road, rail and inland water transport, and participation in global and regional transport connectivity initiatives that help develop the land route links between South Asia and East Asia through Bangladesh.

SASEC Projects in Bangladesh

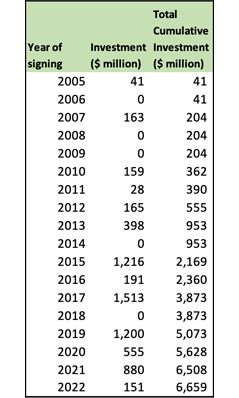

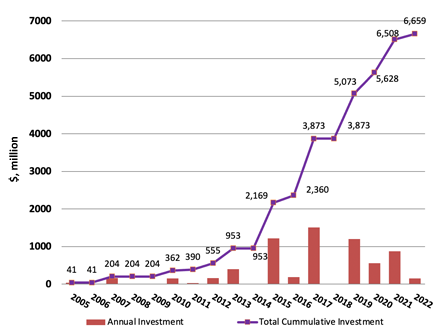

Since 2005, the Government of Bangladesh has signed 20 SASEC investment projects worth over $6.6 billion.

In addition to the projects, ADB-financed technical assistance has supported SASEC investment projects in Bangladesh, regional cooperation forums, and knowledge-sharing initiatives, and pilot projects since 2001. A total of 24 national technical assistance projects (worth over $27 million) have assisted Bangladesh in project preparation, strategic planning, and capacity building.

Trade Snapshot

Direction of Intra-regional Trade

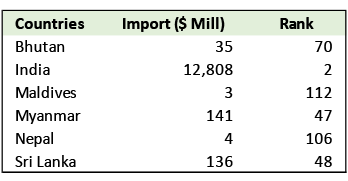

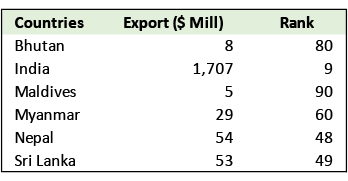

The value of Bangladesh's merchandise exports and imports trade with other SASEC countries, using International Monetary Fund data from 2023, is captured in the tables below.

Bangladesh's top import source, ranking 2nd worldwide, is India, with imported goods valued at over $12.8 billion.

Bangladesh's top export destination in South Asia, and its 9th worldwide, is India, with exports valued at $1.7 billion.

Logistics Performance Index (LPI)

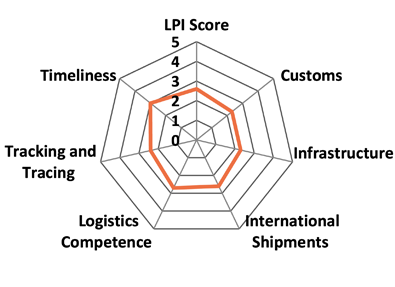

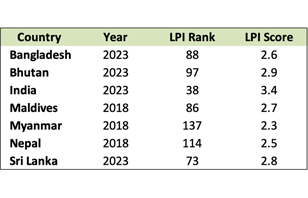

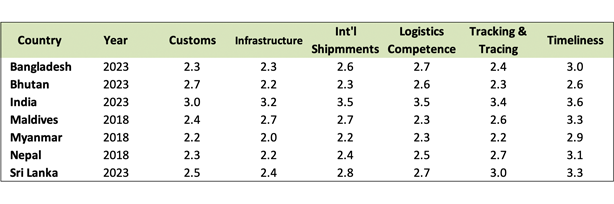

The overall LPI score of 2.6 for Bangladesh in 2023 ranks it at 88 out of 139 economies. The ranking is higher than its LPI ranking of 100 in 2018. Bangladesh posted its best scores in timeliness (3.0), logistics competence (2.7), and international shipments (2.6).

Source: World Bank LPI (accessed May 2023)

Note: The LPI overall score reflects perceptions of a country's logistics based on six core dimensions: (i) efficiency of customs clearance process, (ii) quality of trade- and transport-related infrastructure, (iii) ease of arranging competitively priced shipments, (iv) quality of logistics services, (v) ability to track and trace consignments, and (vi) frequency with which shipments reach the consignee within the scheduled time. The scores for the six areas are averaged across all respondents and aggregated to a single score using principal components analysis. A higher score indicates better performance.

Economic Outlook

Bangladesh's growth momentum was maintained in fiscal year (FY) 2022, projected at 7.2%, supported by rapid rise in external demand, stronger than expected exports and imports, and coordinated fiscal and monetary policy measures. Recovery of domestic demand with the easing of COVID-19 restrictions and rising global commodity prices pushed up inflation, projected at 6.2% in FY2022 and 6.7% in FY2023.

Source: Asian Development Outlook 2022 Update (ADB)

GDP growth in Bangladesh will decelerate to 5.2% in FY2022-2023 due to global economic uncertainty, high inflation, and trade disruptions. Growth of 6.2% is projected in FY2023-2024 with an expected implementation of economic reforms. Exports of readymade garments is expected in FY2022-2023, though external pressures and a global economic downturn is expected to dampen Bangladesh's growth.

Source: South Asia Economic Focus, Spring 2023 (WB)