Myanmar

Myanmar became a full member of SASEC in February 2017, following several years as an active observer. Bangladesh, Bhutan, India, and Nepal formed the project-based partnership in 2001. Maldives and Sri Lanka joined SASEC in May 2014.

Myanmar's National Comprehensive Development Plan (NDCP) A Prosperous Nation Integrated Into the Global Community 2030 envisions a prosperous country integrated into the global community, supported by strategic thrusts in economic development, environmental protection, and the strengthening of governance and public institutions. In view of the changing global and regional economy, Myanmar intends to focus on integration into the global economic system, emphasizing institutional and policy changes, and implementing sectoral and regional strategies.

SASEC Technical Assistance in Myanmar

ADB-financed technical assistance has supported SASEC activities in Myanmar to help advance the country’s engagement in regional cooperation activities, including under the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) framework. Myanmar has actively participated—first as observer, and then as full member—in SASEC regional technical assistance projects that have supported regional cooperation forums, knowledge-sharing initiatives, and capacity building.

Trade Snapshot

Direction of Intra-regional Trade

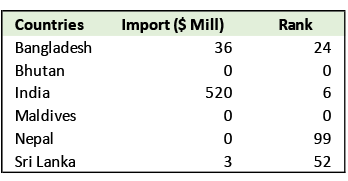

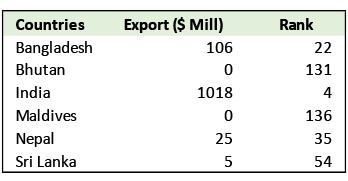

The value of Myanmar's merchandise exports and imports trade with other SASEC countries, using International Monetary Fund data from 2023, is captured in the tables below.

Myanmar's 6th largest import source worldwide is India, with imports at $520 million. Its 24th largest import source is Bangladesh, valued at $36 million.

India and Bangladesh are among Myanmar's largest export destinations—India is Myanmar's 4th largest export market, with exports valued at $1018 million. Bangladesh is Myanmar's 22nd largest market, with exports from Myanmar at $106 million.

Logistics Performance Index (LPI)

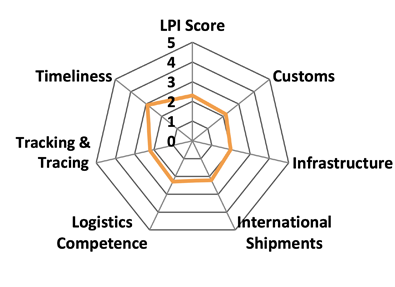

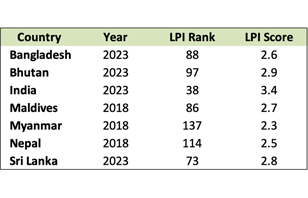

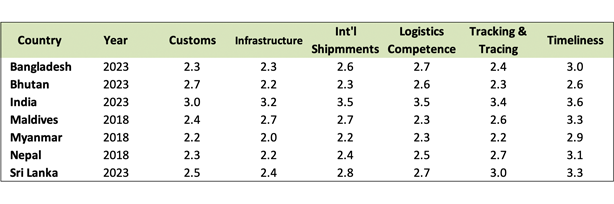

Myanmar's overall LPI score for 2018 is 2.3. The country saw an improved score in timeliness (2.91 from 2.85) and a dip in its scores in the five other categories. It scored 2.28 in logistics competence and 2.20 in both international shipments and tracking and tracing. In 2018, Myanmar ranked 137 out of 168 economies.

Source: World Bank LPI (accessed May 2023)

Note: The LPI overall score reflects perceptions of a country's logistics based on six core dimensions: (i) efficiency of customs clearance process, (ii) quality of trade- and transport-related infrastructure, (iii) ease of arranging competitively priced shipments, (iv) quality of logistics services, (v) ability to track and trace consignments, and (vi) frequency with which shipments reach the consignee within the scheduled time. The scores for the six areas are averaged across all respondents and aggregated to a single score using principal components analysis. A higher score indicates better performance.

Economic Outlook

Myanmar's real gross domestic product (GDP) will grow by an estimated 2.8% in fiscal year (FY) 2023 amid challenges that affect inflation and real growth. Real GDP is projected at 3.2% in FY2024. Inflation is estimated to slow down to 10.5% in FY2023 and 8.2% in FY2024. Strengthening health and social services and the promotion of economic and educational opportunities could help protect the population from future shocks.

Source: Asian Development Outlook, April 2023 (ADB)

Myanmar's GDP is projected to grow by 3% in the FY2023. The country's economy continues to be affected by conflict and energy shortages. Policies for managing the exchange rate could help stabilize the economy and boost trade.

Source: Myanmar Economic Monitor, January 2023 (WB)