Maldives

Maldives became a full member of SASEC in May 2014, together with Sri Lanka, following several years as an active observer. Bangladesh, Bhutan, India, and Nepal formed the project-based partnership in 2001.

The National Development Plan envisions Maldives as an an equitable, prosperous, inclusive, and connected island nation. The plan seeks to explore blue economy concepts, develop global value chains, and advocate gender mainstreaming by maximizing opportunities from its growing digital connectivity, improved infrastructure, and unique environmental and cultural resources.

SASEC Projects in Maldives

ADB-financed project and technical assistance have supported SASEC activities in Maldives to help advance the country's engagement in regional cooperation activities, including under the South Asian Association for Regional Cooperation (SAARC) and the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) frameworks. Maldives has actively participated in SASEC from 2012 to 2014 as an observer, and then as a full member. An ADB-supported national single window project (worth $11.99 million) will help develop an automated system to improve ease of doing business, in line with SASEC operational priorities for trade facilitation. In 2022, APVAX supported Maldives's COVID-19 recovery through a regional cooperation project to upgrade vaccine cold-storage facilities, strengthen distribution, and digitalize vaccine information management.

Three technical assistance projects (worth $3.2 million) support Maldives in implementing its national single window environment for international trade and support preparation for energy projects.

Trade Snapshot

Direction of Intra-regional Trade

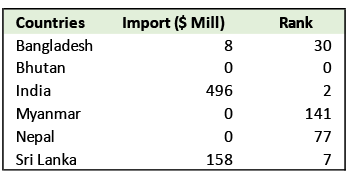

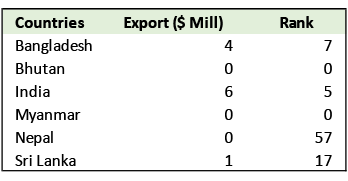

The value of Maldives' merchandise exports and imports trade with other SASEC countries, using International Monetary Fund data from 2023, is captured in the tables below.

Maldives' 2nd largest import source worldwide is India, with imported goods valued at $496 million. Its 7th largest import source is Sri Lanka, with imported goods valued at $158 million.

The country's 5th top export destination worldwide is India, with exports valued at $6 million. Its 7th largest export market is Bangladesh with exports valued at $4 million and its 17th largest export market is Sri Lanka, with exports valued at $1 million.

Logistics Performance Index (LPI)

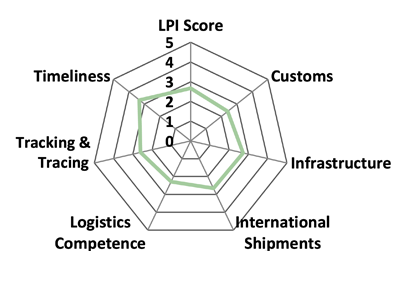

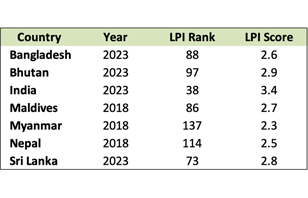

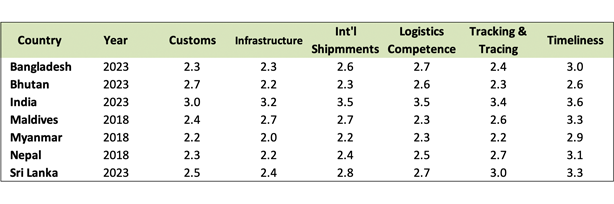

Maldives' overall rank rose 14 notches to 86th place out of 168 economies in 2018, from a ranking of 104 in 2016. Its 2018 overall LPI score is 2.67, up by more than a point from its 2016 score of 2.51. Its 2018 score owes itself to improvements in customs, infrastructure, international shipments, tracking and tracing, and timeliness.

Source: World Bank LPI (accessed May 2023)

Note: The LPI overall score reflects perceptions of a country's logistics based on six core dimensions: (i) efficiency of customs clearance process, (ii) quality of trade- and transport-related infrastructure, (iii) ease of arranging competitively priced shipments, (iv) quality of logistics services, (v) ability to track and trace consignments, and (vi) frequency with which shipments reach the consignee within the scheduled time. The scores for the six areas are averaged across all respondents and aggregated to a single score using principal components analysis. A higher score indicates better performance.

Economic Outlook

GDP growth in Maldives is estimated at 8.2% in fiscal year (FY) 2022 and 10.4% in FY2023 given that tourist arrivals and construction continue to pick up. Construction will slow down in 2023 as government begins implementing fiscal consolidation measures. Inflation in Maldives is projected at 3.3% in FY2022 and 2.8% in FY2023.

Source: Asian Development Outlook 2022 Supplement (ADB)

Maldives is seeing a return to the tourism sector's pre-pandemic levels with GDP growth projections in FY2023 at 6.6% and in FY2024 at 5.3%. Tourism's growth is attributed to the increase in tourist arrivals from India and the Russian Federation, as well as with rising investments in new resorts. Maldives' high external debt and the tightening of monetary policy around the world pose risks to the country's fiscal and external accounts.

Source: South Asia Economic Focus, Spring 2023 (WB)